Latest News

- Hyundai E&C Employees Spread Holiday Warmth to Underserved Neighbors in the Community

- Hyundai E&C Launches ‘Winter Site Safety Inspection Relay Campaign’

- Hyundai E&C Becomes First to Surpass KRW 10 Trillion in Urban Redevelopment Orders

- Hyundai E&C Recognized as a ‘Company that Contributes to the Local Community’ with Highest Grade for 3 Consecutive Years

- Hyundai E&C Publishes Brand Book Commemorating 10th Anniversary of ‘THE H’

[TREND INSIGHT] Five Game Changers That Are Transforming the World

The world is now in the throes of transformation. Changes that once occurred on separate axes—the climate crisis that followed the pandemic, geopolitical conflicts, the digital transition—are now converging simultaneously. Major global research institutions unanimously agree that we are at an ‘inflection point.’ This is an era where survival hinges on the ability to read the ‘signals’ of a change that has already arrived, not on mere prediction. Let's re-examine the key megatrends that are slated to profoundly impact the construction industry.

01. Keyword: ESG Action

Merely Reporting on ESG Is No Longer Enough!

Carbon neutrality, sustainability, ESG… These are no longer unfamiliar terms. Companies everywhere are publishing ESG reports and brandishing eco-friendly certifications. However, the question from the wider world market is also evolving: "How much of that report represents actual implementation?"

The World Economic Forum's (WEF) 2024 Global Risk Report identified the failure to mitigate climate change as the most severe risk to humanity over the next decade. In the 28th Global CEO Survey by consulting firm PwC, 42% of CEOs worldwide admitted, "If we continue on our current path, our companies may not be viable in ten years," citing inadequate ESG response as a key threat.

This shift is a particularly critical signal for the construction industry. Infrastructure projects worldwide now include ESG standards as bidding prerequisites, and construction firms that are passive in their ESG response will inevitably be at a competitive disadvantage. Conversely, companies that integrate ESG alongside their technological prowess can secure a differentiated edge on the international stage.

Indeed, the change is already underway. The European Union has mandated ESG disclosure through its Corporate Sustainability Reporting Directive (CSRD), and the UK imposes fines of up to 10% of turnover for greenwashing. Global clients now demand specific ESG criteria as bidding conditions, such as membership in RE100 (a global initiative for companies committed to 100% renewable energy) and compliance with CBAM (the EU’s Carbon Border Adjustment Mechanism). Korea, too, has begun to recognize only 'truly eco-friendly' initiatives through its K-Taxonomy. Major domestic construction firms have started to substantively manage and disclose detailed ESG metrics, including greenhouse gas reductions and the use of eco-friendly materials. ESG is no longer an option but a core competency that determines if a company secures new contracts. Greenwashing is no longer a viable excuse. The time has come to speak through action.

02. Keyword: Smart City Software

The Subscription Era for Smart Cities Has Arrived

"How smart is the city you live in?" This question is rapidly becoming a key benchmark for a city's future value. According to the Boston Consulting Group (BCG), the global smart city market is projected to soar from $400 billion in 2021 to $1.4 trillion by 2030. McKinsey & Company has forecasted that smart city technologies can improve citizens' quality of life by 10-30% and has predicted that by 2050, 68% of the world's population will reside in cities.

[ The Netherlands' Amsterdam, a hub for citizen-led smart city projects (left), and Singapore's government-driven Smart Nation project (right) ]

However, a smart city's competitive edge lies not in the latest technology itself, but in the 'software platform' that integrates and orchestrates the entire urban operation. The construction industry is now moving beyond the building of physical infrastructure to play a central role in the digital transformation that connects a city's data and designs its services.

In Korea, major construction firms are actively participating in the development and demonstration of smart city platforms—encompassing data-based integrated control, real-time management, and customized service planning—in urban environments such as Busan Eco Delta City, Sejong Smart City (a National Pilot City) , and Pangyo Zero City. Internationally, smart city development models founded on Public-Private Partnerships, such as Singapore's 'Smart Nation,' Dubai's 'Smart Dubai,' and the Netherlands' 'Amsterdam Smart City,' are rapidly proliferating.

Notably, the trend of bundling key smart city services—like transportation, energy, and security—into a single subscription-based package is gaining momentum, particularly in advanced economies such as Singapore and Finland. The city of the future is not merely a space; it is a 'service product designed with integrated data and software.' Only those construction firms that can leverage data and platform capabilities will secure a competitive advantage in tomorrow's urban landscape. The time to pioneer 'innovation in operation' is now, moving beyond technology alone.

03. Keyword: Return of Factories

In an Era of Returning Factories, Opportunity Returns Anew

For a long time, the world considered the 'global division of labor' to be the pinnacle of efficiency. Production bases migrated across borders in pursuit of cheaper labor, and logistics chains spanning thousands of kilometers to produce a single component were the norm. But that very system of efficiency is now being fundamentally shaken.

In a recent report, McKinsey warned that “persistent supply chain disruptions could result in a loss of up to 30% of a company's EBITDA over the next decade.” BCG also revealed that over 90% of North American manufacturing firms have already begun relocating their production or supply chains, with half moving more than 20%—an increase of approximately 250% compared to 2012. The message from these companies is clear: "To mitigate risk, the factories must come back."

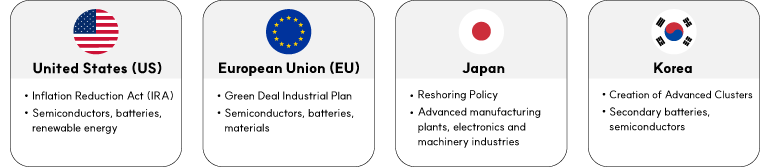

The United States is incentivizing the return of manufacturing through the 'Inflation Reduction Act (IRA),' providing subsidies and tax benefits for key industries like clean energy, semiconductors, and batteries. The EU is bolstering the self-sufficiency of its strategic industries with the 'Green Deal Industrial Plan,' while Japan is subsidizing up to two-thirds of facility investment costs for reshoring companies. Korea is also moving swiftly. Central and local governments are creating industrial clusters for secondary batteries, semiconductors, and hydrogen, primarily in the Chungcheong, Jeolla, and Gyeongbuk regions. Concurrently, the development of advanced manufacturing complexes on the outskirts of the Seoul Metropolitan Area is gaining momentum. Prime examples of this movement include the 'Yongin Semiconductor Cluster' and the 'Saemangeum Secondary Battery Specialized Complex .'

This industrial reorganization presents both a challenge and an opportunity for the construction industry. When factories return, they inevitably need facilities to be built. The demand is not for simple factory structures, but for advanced manufacturing facilities incorporating energy efficiency, smart processes, and carbon-reduction designs—demand that is exploding. McKinsey forecasted that a manufacturing recovery in the U.S. could generate up to 1.5 million new jobs and contribute an additional $275 billion to $460 billion to the GDP. In essence, the next generation of industry leaders will be determined by who possesses the capabilities to design, build, and operate these facilities first.

04. Keyword: Energy Transition

In an Era of Rebuilding Energy, the Role of Construction Is Being Redefined

The global energy market has reached a pivotal turning point. The global energy market research firm BloombergNEF projects that "by 2050, over 67% of the world's electricity will be supplied by renewable sources," while the International Energy Agency (IEA) has determined that "achieving climate goals will require an annual investment of $600 billion in transmission grids by 2030." McKinsey concurs, stating that “the shift away from centralized power generation systems toward region-based, distributed infrastructure is inevitable, a transition that will more than double the number of energy infrastructure projects.” This colossal change is setting a new stage for the traditional construction industry. Construction firms must now evolve beyond simply building power plants to undertake complex and challenging projects that involve 'rebuilding the power grid itself'—including ultra-high-voltage transmission infrastructure, smart substations, Energy Storage Systems (ESS), submarine cables, and microgrids.

Grid redesign projects are already advancing rapidly in key markets across Europe, North America, and the Middle East. The United States is investing over $13.5 billion in grid modernization alone through the IRA, while Middle Eastern nations, including Saudi Arabia, are scaling up their investments in smart energy infrastructure. Since 2024, Korea has also been expanding its ultra-high-voltage submarine cable transmission projects and distributed microgrid demonstration complexes. Major Korean construction companies are bolstering their global competitiveness by securing a succession of advanced infrastructure projects—such as large-scale solar power, smart transmission grids, and High Voltage Direct Current (HVDC)—in the U.S., the Middle East, and other international markets.

Construction is no longer merely the act of building physical structures. It must become the architect and facilitator of the energy transition. Amidst the sweeping trends of carbon neutrality and distributed energy, only construction companies that act decisively will emerge as the leaders of the new infrastructure paradigm.

05. Keyword: AI-based Construction Innovation

AI Has Arrived on Site, and Construction Is Being Transformed

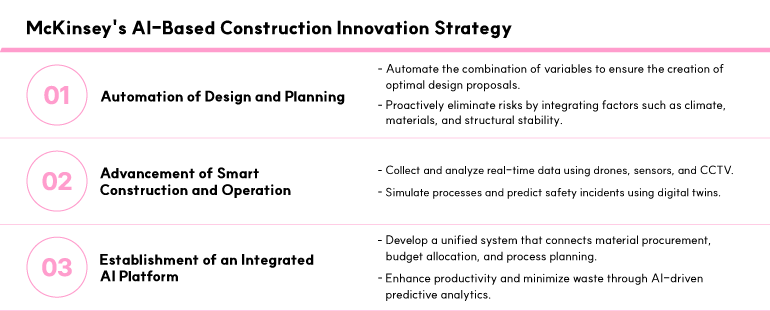

The construction industry was once considered a 'laggard' in the digital transformation sphere. Recent trends, however, have reversed this perception entirely. In its 2024 report, the global market research firm PwC noted that "the impact of AI on the construction industry will be so profound as to redefine the entire industry's mode of operation." McKinsey also emphasized that "AI is not merely a tool for automation; it will function as a strategic decision-making instrument across all stages of design, construction, and operation." Major global studies have confirmed that the adoption of AI and digital technologies on-site has yielded productivity gains of 15-20% and cost reductions of 10-15%.

In the design phase, AI can complete complex structural calculations in a matter of seconds. Building Information Modeling (BIM) technology allows for risk simulation before construction even begins, while drones and sensors gather real-time data from across the entire site. Digital twins go a step further, creating a virtual counterpart of a city to simulate processes in advance.

Moving beyond simple 'automation' or 'efficiency,' AI is now redefining every phase of construction. From budget allocation, process planning, and material procurement to safety monitoring, superior choices can now be made with a single click and a few lines of an algorithm. The digital transformation of the construction industry is no longer a choice but a necessity. And this change is unfolding far more rapidly and quietly than one might think.